The Two Token Waterfall

A liquidity-optimized framework for tokenizing private placement securities

Abstract

We provide a structural framework for representing the entire capital stack of alternative investments in a digital format so that we can leverage distributed ledger technology to store and transfer interests. We create two separate tokens: one senior in priority of payments replicating debt and the other junior in priority of payments replicating equity. A simple two-token structure can incentivize both parties to perform optimally. Regulatory compliance and adherence to the legal agreements is codified into the smart contract. Administration of the tokens is via third party administrative agent/trustee multi-signature wallet. The structure represents a simple framework that is generalizable beyond two tokens and can potentially be replicated for more sophisticated deal types. With this mechanism we are bringing structured finance to the blockchain ecosystem in a compliant manner while enabling investors to more easily access liquidity.

The Liquidity Problem

Private placements in the form of funds, private REITS, and discrete structured transactions in alternative asset classes such as real estate are generally deemed "held-to-maturity" by investors with no expectation of early redemption. Secondary trading of interests do occur, but are infrequent, cumbersome, and typically trade at prices significantly below net asset value (NAV). There are a host of reasons behind this. With proper structuring, tokenization addresses a broad spectrum of these issues, allowing for easy ownership transfer. Removing this transactional friction potentially enables liquid markets to emerge.

For the token economy to grow, blockchain-based capital formation needs to be accepted and adopted by established institutional capital within the current portfolio allocation and governance paradigms.

Evolution toward obtaining a more efficient issuance paradigm is ongoing. Initial blockchain-based capital formation companies have laid claim that simple decentralization of custody allows for the listing and thus market formation on one of many exchanges. Unfortunately, simply listing a security on an exchange does not solve the fundamental problems of liquidity: this is the equivalent of listing one's house on a bulletin board with only its address and maybe a price.

Background

Under the Securities Act of 1933 (Securities Act), all offers or sales of securities must be registered with the Securities and Exchange Commission (SEC) or meet an exemption from registration. Regulation D of the Securities Act (Reg D) provides a number of exemptions from registration which are typically relied upon by issuers conducting private placements. This allows smaller companies to raise capital by selling debt or equity securities to select investors, without registering those securities with the SEC and incurring the costs associated with a public offering. The Reg D issuance volume for 2016 was $4.2 trillion.

The last major revision to Reg D came following the SEC's implementation of the Jumpstart Our Business Startups (JOBS) Act in 2013, which introduced Rule 506(c), allowing issuers to generally solicit private placements subject to certain conditions. This was a useful step in that it:

- Broadened investment access

- Acclimated investors to online crowdfunding

However, widespread adoption and growth has been underwhelming in large part due to:

- Lack of standardization

- Offerings being wholly centralized to the issuer and platform

- Perception of adversely selected deals

- No efficiency for the issuer vs the legacy model

Historically, liquidity has been neither a concern nor a goal when private securities are sold into the market. In most cases, the firms which originate and brokers who sell these securities make all their fees and commissions at the time of sale. Ownership remains centralized and reporting of information is periodic, shared exclusively with the investors. Additionally, the market presumes premature sales will occur at a deep discount to intrinsic value. It remains a calculated tradeoff for the investor: higher return vs. liquidity. The equilibrium that exists can be shifted, as yield premiums will be reduced as liquidity increases.

Defining Liquidity

Liquidity, the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset's price, has often been a topic of theoretical and academic research.

Kyle (1985) identifies three components of market liquidity:

- Tightness is the bid-ask spread

- Depth is the volume of transactions necessary to move prices

- Resiliency is the speed with which prices return to equilibrium following a large trade

Glosten and Harris (1988) estimated the components of the bid/ask spread.

The bid-ask spread breaks down into two components:

- One due to asymmetric information, and

- One due to inventory costs, specialist monopoly power, and clearing costs

Persaud (2001) identifies a fourth component, which he calls diversity. This is simply the degree of diversity among market participants in their market views and desired trades. Persaud argues that lack of diversity can lead to liquidity in black holes.

The use of blockchain tokens is the natural evolution of issuing securities and has the potential to resolve many of the legacy impediments to liquidity in private markets.

Requirements

A proposed solution must have the following characteristics:

- Compatible - evolve legacy structure that adapts already accepted market alternative structures. Optimize structure to create alignment of interest between disparate tranches

- Transparent - issue an entire capitalization in token form to provide a transparent view through capitalization to underlying asset, and minimizing structural components

- Encodable - provide all salient valuation information to token holders in a timely manner

Introducing The Two Token Structure

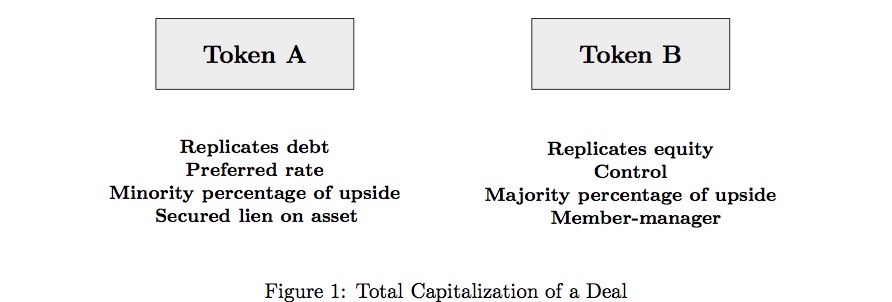

We propose a two token structure to replicate both debt and equity classes. The classes, in sum, represent the total capitalization of the transaction. We represent both entity interests as tokens. Tokens are fungible, and tradeable subject to compliance with securities laws.

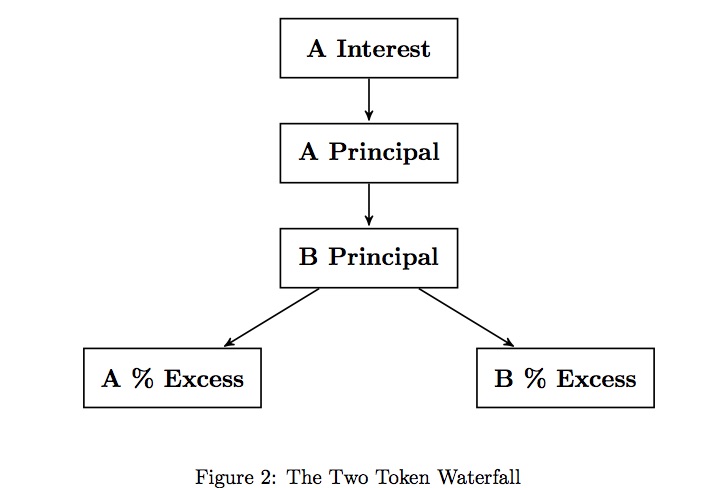

The Waterfall

Waterfalls are simply cash flow directives where capital events are the triggers. In other words, it's simply how capital flows to the holders when there is a payout event. By utilizing a common, simple waterfall structure, and encoding the regulatory components and structural attributes on a token, many of the legacy issues that have hampered liquidity can be resolved.

Characteristics

The broader blockchain community is likely unfamiliar with nuanced concepts in structured finance, as the typical finance investor is likely unfamiliar with blockchain and tokenization. With this structure we minimize the variable components of a capitalization to simplify analysis and isolate the components of liquidity, making it work well for both audiences. Also, it embeds interest alignment between the constituents to ensure optimal behavior and reduce skepticism in both classes.

The following is a generic asset-backed example to illustrate the legacy model of financing as a basis for the evolution into the token economy.

Suppose an issuer is looking for a financing structure for a non cash flowing hard asset, whereby the business model expects a sale in some short time period. The legacy lender model would issue a short term loan with a high interest rate, and other covenants that assure strict compliance with the proposed timing of the business plan. The issuer is left to arrange the structure and the rest of capitalization in a bespoke manner to be compliant and achieve acceptance by all parties. The lender maintains divergent priorities from the issuer in the conception of this structure.

Legacy vs. Two Token Structure

| Tranche | Loan [Legacy] | Token A [2T Structure] |

|---|---|---|

| Maturity | Short | Flexible |

| Interest Reserve | Yes, full term | No |

| Minimum Interest | Yes | No |

| Interest Pay | Monthly | Accrual |

| Profit Participation | No | Yes |

| Interest Rate | High | Moderate |

| Risk Mgmt / Portfolio Rebal | No | Yes |

| Capitalization Issuance | Single tranche | Total |

With the implementation of this construct, duration and minimum interest lessens as a concern. In both the short and long-term cases, the split profits to the A-token mitigate concerns of unrewarded risk and undue enrichment of the B-token. Suppose a profitable offer for the asset was submitted during the minimum interest period; the loss of interest is compensated by the profit participation. Likewise, suppose a profitable offer for the asset was submitted towards the end of the extended term, the profit participation offers the compensation equilibrium for both classes.

The elimination of the interest reserve and current monthly pay provides a more transparent and simplified representation of current balance. It also eliminates any need to address issues around stablecoin and interim distribution. The preferred return/profit participation split ratio will price at an equilibrium that establishes a trust between the two parties and ensures they are working toward the same goal.

Another way to think about the two token structure vs. a legacy loan structure is how much upside the lender should get for taking a discounted minimum return rate. Mathematically defined, the present value of the cashflow differential due to rates must be in equilibrium with the perceived price of the call option on the profit participation component. Both components - elimination of interest reserve & profit participation - could be adjusted back to the legacy loan parameters and a similar but lessened improvement on liquidity would occur because of the issuance of the total capitalization.

By issuing both tokens in the marketplace, the transparency through the capitalization to the underlying asset encourages the formation and development of secondary markets.

In Practice

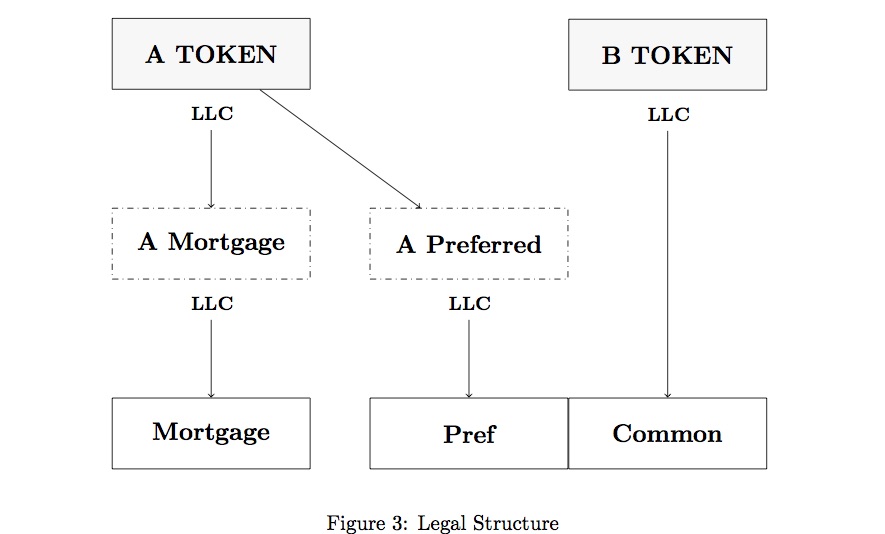

We can define an organizational chart with proper legal entities to manage the tokens in the proposed structure.

Value Transparency

The existence of two tokens tradeable on a secondary market attract traders and remains in equilibrium because we can construct a formula to represent the full value of the asset. The sum of the both tokens equals the underlying asset price; therefore the same ratio of tokens represents a fractional ownership of the asset. This construct encourages speculation and arbitrage trading in each class. Because it is formulaic, the asset price is transparent and not subject to discretion, making a more liquid market overall.

Aligned Incentives

With the B-token (equity) holder typically being the issuer, the optimal solution would be for the lender to offer time without cost prohibitions so that a sale or capital event could occur. Since the timing of such a window of execution is unknown, the issuer would look for flexibility of execution to optimize their fiduciary duty.

The A-token (debt) holder has collateralized return and potential for upside. This effectively replaces the senior lender or bank in many transactions. The split of the upside equalizes the flexible timing of the future capital event.

The B-token holder has flexibility, can still maintain the property, and in the event of a down market can hold the property longer until prices stabilize. They do not pay interest on an ongoing basis, they simply accrue and are paid when the deal matures. Therefore, there are fewer cash requirements. They must give a percentage of the upside in return for this flexibility.

Distributed Ledger Technology

Distributed ledger technology provides a platform that can easily store financial transactions. It provides the clearinghouse that all actors agree is the "state of the world". There is no need for a central party or intermediary to serve as a mechanism to establish who owns what and how that asset is safely transferred.

Tokens are a standard for representing assets as smart contracts on distributed ledger technology networks. By sharing standards, any actor on the network can implement basic functionality, such as looking up who is whitelisted to hold a given security and transferring tokens from one counterparty to another.

Smart Contract

We have selected Ethereum as it benefits from standardization, a significant developer community, and interoperable protocols. Transparency is provided out of the box with Ethereum smart contracts. Tokens are fungible and will represent the interests in both Token A and Token B vehicles of the two-token structure.

Compliance Checks

Participants will rely on trusted third parties to collect the data required to enforce compliance. In the blockchain context, these are known as "Oracles". All executing parties in the primary and secondary markets will adhere to the rules set in the smart contract because they are encoded.

In our example the following will be placed onto Ethereum by these trusted Oracles:

- Whitelisted exchange contracts (only exchanges which match the listing requirements)

- Whitelisted wallet addresses in the token smart contract (pull list from Oracle)

- Transfer restrictions, preventing tokens from trading based on specific criteria

- Cap on number of holders

Administration

An administrator of the token smart contract itself is required to perform basic functions:

- Ability to burn and reissue tokens in the event investor wallets are lost

- Ability to update whitelisted addresses

- Ability to flip between analog and digital world

- If administrator goes away, tokens are burned and moved to analog world

This is to ensure both regulatory compliance and that investors can never "lose" their tokens.

Trustee and Servicer

A third party trustee must be appointed to:

- Administer the legal documentation

- Provide a physical presence and signatory authority on behalf of the token holders

- Verify issuer reporting

- Reconcile holders, balances, and trades

- Generate tax documentation

A servicer must be appointed or employed to:

- Generate token balances and/or statements

- Manage distribution of proceeds

Custody

Custody of assets remains a pain point for many token projects as each token requires approval from a regulated body in order to maintain custody. Minimum capital requirements are also required.

In a custodial exchange, these limitations make the seamless listing and trading of tokens much more difficult thus removing one of the value propositions of tokenization - the ability to provide liquidity in long-tail assets.

Therefore a non-custodial exchange is recommended.

Custody of tokens can be maintained in a digital or analog world and a servicing layer would be required to switch between the two. In this construct, all investors can participate. The analog investors receive a free option of secondary market liquidity.

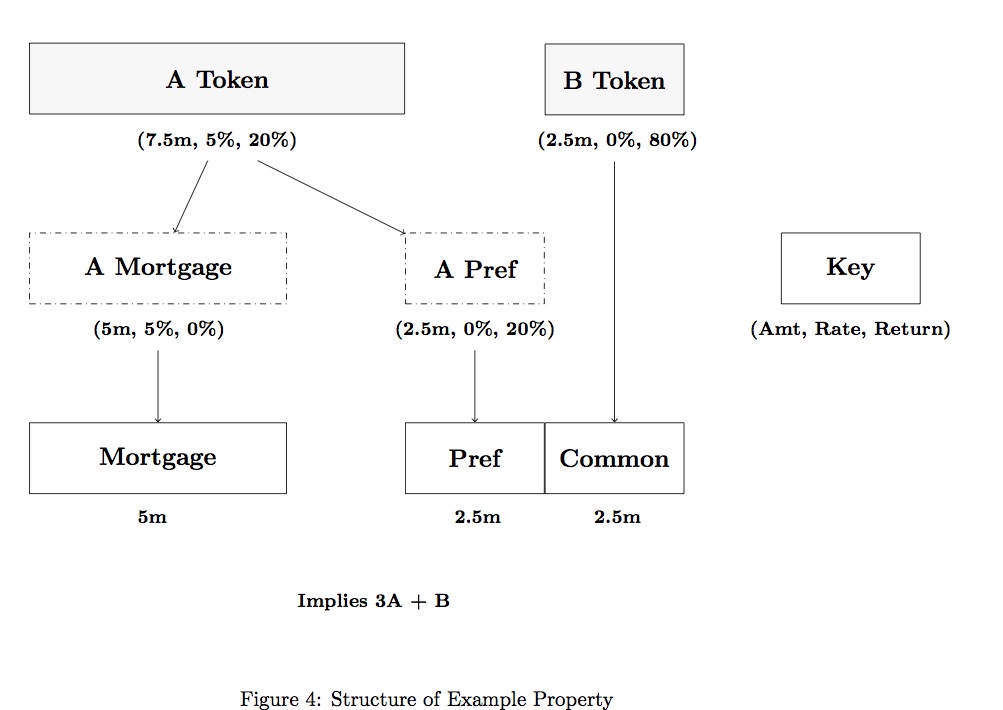

Detailed Example

To further understand the structure, let's give a bit more detail to our original example. Our non cash flowing bridge loan takes on the following attributes of a bridge loan on a newly constructed, unoccupied building.

| Tranche | Variables |

|---|---|

| Current asset value | $10m |

| A-token | $7.5m |

| B-token | $2.5m |

| A-preferred rate | 5.0% |

| Split | A:20% B:80% |

| Term | 2 years |

For the sake of simplicity, we ignore the market's perception of interest rates now and in the future, and the relative interest rate spreads to benchmarks reflective of credit risk.

Suppose that $7.5m of the A-token is sold at issuance and the issuer holds $2.5m of the B-token. We will also assume that trading is frictionless, compliant, and immediate.

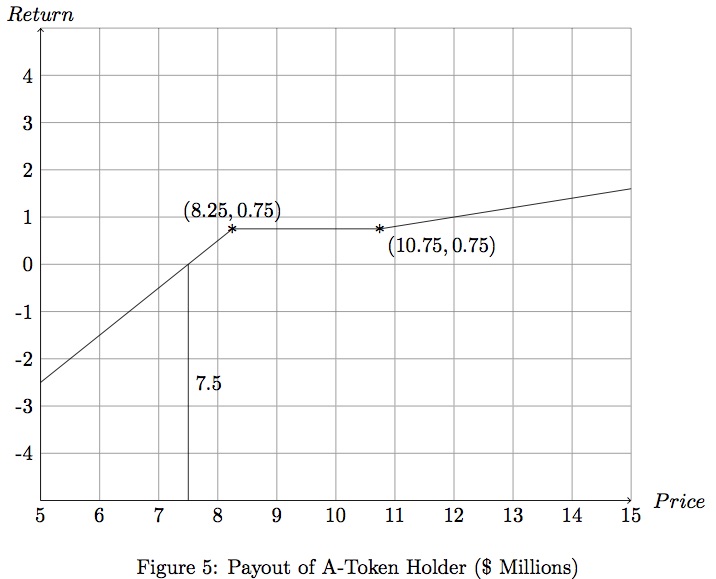

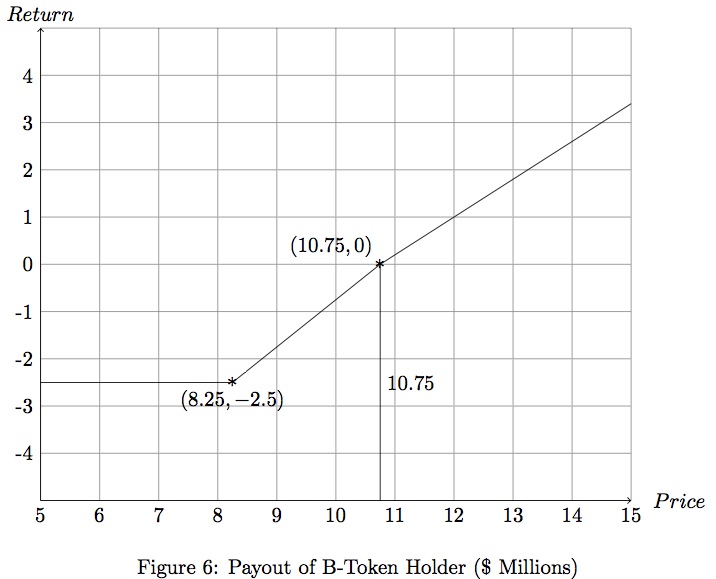

At maturity, we assume the property is sold in the $5m, $10m, $11m, and $15m scenarios. The waterfall pays in the following order: (A interest, A principal, B principal, A and B upside)

Token A holds $7.5m notional, 5% pref, and 20% of the upside.

| A Holder | $5m | $10m | $11m | $15m |

|---|---|---|---|---|

| A - Int | $0.75 | $0.75 | $0.75 | $0.75 |

| A - Prin | $4.25 | $7.5m | $7.5m | $7.5m |

| A - Excess | $0 | $0m | $0.05m | $0.85 |

| TOTAL | $5m | $8.25m | $8.3m | $9.1m |

| NET | -$2.5m | +$0.75 | +$0.8m | +$1.6m |

Token B holds $2.5m notional and 80% of the upside.

| B Holder | $5m | $10m | $11m | $15m |

|---|---|---|---|---|

| B - Prin | $0m | $1.75 | $2.5m | $2.5m |

| B - Excess | $0m | $0m | $0.2m | $3.4m |

| TOTAL | $0m | $1.75m | $2.7m | $5.9m |

| NET | -$2.5m | -$0.75m | +$0.2m | +$3.4m |

Graphically:

The arbitrage-free structure promotes trading. As a result of the simple formulaic nature of the return profile for each token vis-à-vis the waterfall, each token price directly implies pricing for the underlying asset independently. Thus, any set (A, B) of token pricing that results in a discrepancy of underlying pricing implications invites an investor or trader to take advantage of the disconnect. By buying the lower price implied token or selling the higher implied price token, the investor can reap the benefits of the price convergence at the asset's time of sale.

A Liquidity Solution

We have provided a comprehensive framework for applying blockchain technology to the entire capitalization of a transaction. One with a view on the value of the entire asset can imply pricing of each token. We can now show this structure solves the liquidity paradox in private securities.

To increase liquidity, we must address the tightness of the bid-ask spread, depth of volume requires to move prices, and resiliency of the market returning to equilibrium. Through the two token waterfall, all three components are increased dramatically.

Tightness of Bid-Ask Spread

Recall the bid-ask spread is decomposed into two parts:

- One due to asymmetric information, and

- One due to inventory costs, specialist monopoly power, and clearing costs

Asymmetric Information

The existence of transparent smart contracts allow adverse parties to see the entire supply and holdings of other actors in the market. When coming to execute a trade, the existence of this information will allow the party to make more educated buying or selling decisions, helping to ensure that prices stay near intrinsic value.

For example, if an investor sees that the majority of outstanding tokens are held by a single party, they may know that the single party might be more willing to control the prices in the market, causing the individual to not want to participate, which in turn causes the individual to demand better pricing to participate at all. If an investor sees the majority holder attempting to sell a majority portion, this will cause other parties to believe the seller is acting on inside information and therefore will not face them on the trade.

Transparent holdings in smart contracts reduces the likelihood of asymmetric information.

In our example, the valuation of the token is objectively defined by the price of the asset. For assets defined less objectively, such as corporate equity, the transparency of ownership would correlate strongly to liquidity.

Clearing Costs

Clearing costs, or the cost to transfer assets, are reduced to near zero through peer to peer value transfer via smart contracts on the Ethereum network.

Inventory Costs

The ability for smart contracts to interoperate may enable borrow markets to emerge, allowing for leverage and the cost of capital to decrease significantly. This is a medium term benefit that may be realized through protocols on the Ethereum network.

Volume Required to Move Prices

Introducing two tokens which are tied to the value of the property and replicating the entire financial stack will encourage market participants to trade the tokens, because the assets can be priced easily. In the future, professional traders may arise in these assets as they are more easy to price and can be held to maturity if there is any discrepancy in value. With market makers, more trades will be required to move through prices, effectively increasing liquidity in the asset.

Resiliency of Market Moving to Equilibrium

The existence of a secondary market where transactions occur within a reasonable time frame can decrease the time required to move back to market equilibrium. This advantage is not unique to the two token waterfall rather the existence of any secondary market where parties can find prices will help this point.

Diversity

The non-academic issue with the private securities market has been engagement. An investor must sort through securities platforms, select an offering, and then analyze the asset, investment, and issuer.

Since an investment offering is typically limited to a single class, the investor performs their analysis to arrive at a yes/no answer. Perhaps the risk/return profile doesn't work, or there is the perception that another class in the deal, not issued, is benefitting from the pricing and issuance of the available class.

In offering the total capitalization (in our example, A: low risk / low return; B: high risk / high return) the investor can specifically tailor their investment to their preferred risk/return profile by creating a bespoke selection of offered classes. Investors are more likely to engage and perform their own analysis if they believe they can arrive at an arrangement well suited to the parameters of their risk/return profile.

Increased engagement through tokenization and a representative deal should increase the overall diversity of holders helping liquidity.

Summary

Transparency begets liquidity. Defining and tokenizing the whole capitalization offers an unprecedented opportunity to technologically increase liquidity in the private placement markets.

The implementation of this proposed structural framework resolves the fundamental constraints of the bid/ask spread and thus induces liquidity.

Information asymmetry is resolved by structure and the arbitrage-free nature of full capitalization issuance. The price of each token is easily derived from the asset price, and vice versa. Each token should fluctuate due to available information on underlying asset price, and to a lesser extent, prevailing market interest rates and perception of forward interest rates. Ownership transparency reduces the detrimental effects of monopolistic power. Clearing and inventory costs are resolved by the friction-free nature of blockchain transactions and wallet efficiency.

Additionally, with regulatory smart contracts, asset management costs for suitability and transferability are negligible. Adherence to existing legal structures and securities regulations, as well as trustee/servicer best practices, make an offering compatible with institutional investment guidelines, encouraging participation.

By making the entire capitalization stack available, investors have the ability to create their own risk/return profile, thus increasing engagement.

With the academic hindrances to liquidity mitigated or resolved, and the broadened appeal encouraging participation from more investors, the two token structure provides a basic framework for optimized liquidity in the private placement and security token markets.

The solution proposed is meant to address certain sub categories of asset backed capitalization. The two token structure can be adapted to offer transparency and liquidity to company funding rounds in a simpler use case. The framework can also be expanded to include multiple token structures with multiple levels of subordination, time tranching, amortization, interim dividends, etc. to replicate more complicated deal structures. We welcome community feedback and thoughts.

For questions, comments, or feedback, please reach us at info@propellr.com.